BFSI course full form is Banking, Financial Services, and Insurance. These courses are designed to provide comprehensive knowledge and skills pertinent to the BFSI sector, encompassing areas such as banking operations, financial markets, investment strategies, and insurance principles. The curriculum aims to prepare individuals for various roles within the financial industry.

Course Overview

BFSI courses are structured to offer an in-depth understanding of the financial sector’s multifaceted components. A notable example is the Certified BFSI Professional Course, a collaborative initiative by the National Institute of Securities Markets (NISM), the Indian Institute of Banking & Finance (IIBF), and the National Insurance Academy (NIA). This program spans approximately 187 hours of e-learning, divided into three semesters, covering:

- Banking and Finance: Topics include the Indian economy, banking products and functions, digital banking, marketing of banking services, accounting principles, and international banking.

- Securities Markets: Subjects such as the introduction to securities markets, regulatory frameworks, role of intermediaries, primary and secondary markets, and risk management are explored.

- Insurance: Modules cover fundamentals of insurance, legal frameworks, various types of insurance (life, fire, marine, motor), and insurance accounting.

The course is designed to be completed over a period of six months, with each semester lasting two months. Upon successful completion, participants receive a co-branded certificate from NISM, IIBF, and NIA.

Eligibility Criteria

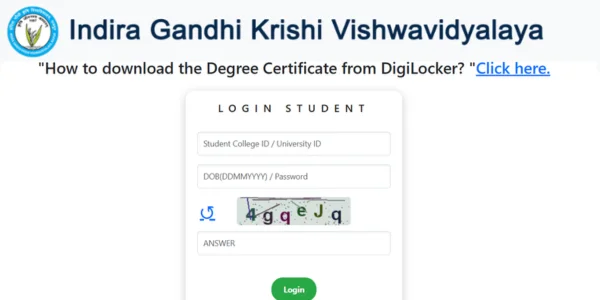

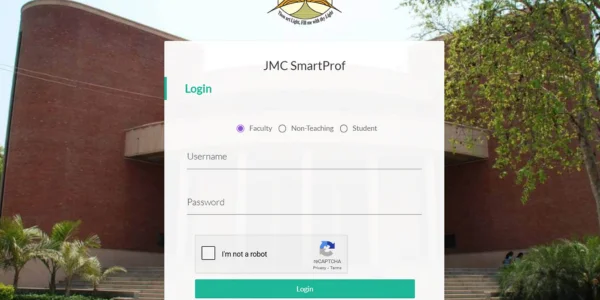

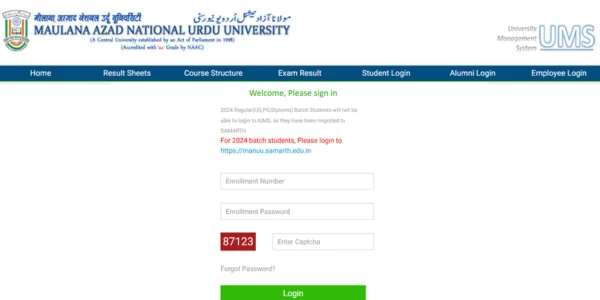

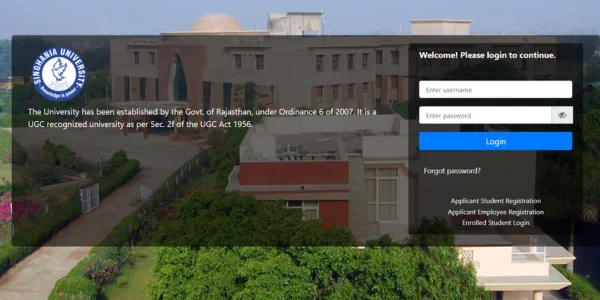

To enroll in BFSI courses like the Certified BFSI Professional Course, candidates should be graduates or currently pursuing graduation from a government or UGC-recognized college or university. Specific eligibility requirements may vary depending on the institution offering the course.

Career Opportunities and Scope

Completing a BFSI course opens diverse career avenues in the financial sector, including roles such as:

- Banking: Positions like probationary officers, relationship managers, and credit analysts.

- Financial Services: Roles in investment banking, wealth management, and financial advisory services.

- Insurance: Opportunities as underwriters, claims managers, and insurance advisors.

The BFSI sector is integral to the economy, and professionals with specialized training are in high demand. The industry’s growth, driven by digitalization and financial inclusion initiatives, further enhances the scope for qualified individuals.

Conclusion

BFSI courses provide a structured pathway for individuals aiming to build a career in the financial sector. By covering critical aspects of banking, financial services, and insurance, these programs equip participants with the necessary expertise to excel in various professional roles within the industry.